Category: Stock Market

-

Why the Death of Enterprise Software is a Massive Misconception

If you’ve turned on financial news lately, you’ve likely heard the eulogies for the software industry. The narrative is breathless and confident: Artificial Intelligence is coming for Software-as-a-Service (SaaS). We are told that “vibe coding”—the ability for non-technical users to simply prompt an AI to “build me an app”—will render multi-billion dollar enterprise platforms obsolete. Read more

-

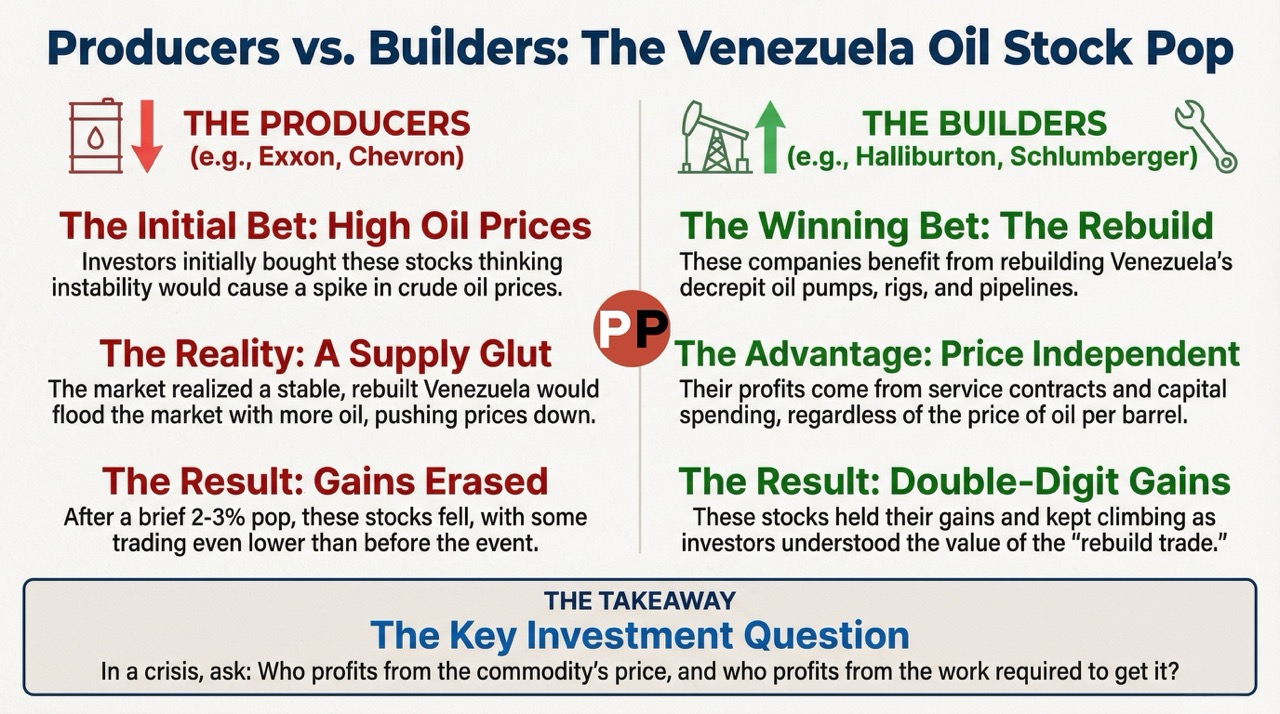

The Venezuela Pop: Why “Oil Stocks” Aren’t All Created Equal

If you’ve been watching the headlines since the weekend, you know the world changed on January 3rd. The execution of Operation Absolute Resolve—the U.S. military operation that resulted in the capture of President Nicolás Maduro and Cilia Flores—sent shockwaves through geopolitical circles. But as always, the financial markets didn’t wait for the dust to settle Read more

-

The “Pick & Shovel” Playbook: How to Profit from Trends Without Buying the Hype

Everyone knows the story of the California Gold Rush. The people who made the most consistent fortunes weren’t the prospectors panning for gold in the river; it was the merchants selling them picks, shovels, and denim jeans. In modern investing, we see the same pattern. When a massive trend hits the market—whether it’s AI, weight Read more

-

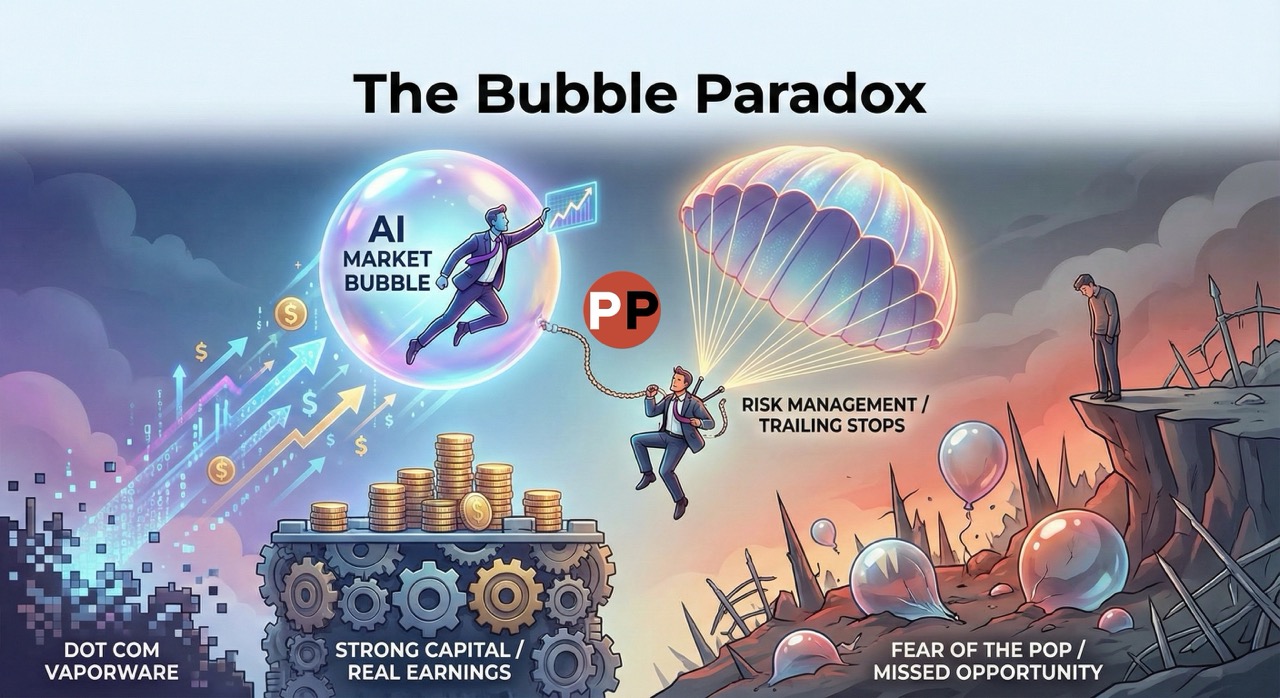

Stock Market Bubble: Why Fear of “The Pop” Is Costing You a Fortune

Everyone loves to talk about bubbles. It is the favorite pastime of financial pundits, Twitter gurus, and your cautious uncle at Thanksgiving. Right now, the target is Artificial Intelligence. “It’s the Dot Com bust all over again,” they warn. “It’s 1999. The crash is coming.” And they might be right. Eventually. But here is the Read more

-

The 5-Step Cycle of Stock Market Manipulation

If you have ever looked at the stock market and felt like it was a chaotic, rigged game working specifically against you, your instincts aren’t entirely wrong. You aren’t just battling random market noise; you are often up against coordinated strategies designed to take your money. What many retail traders experience—the maddening sensation that selling Read more

-

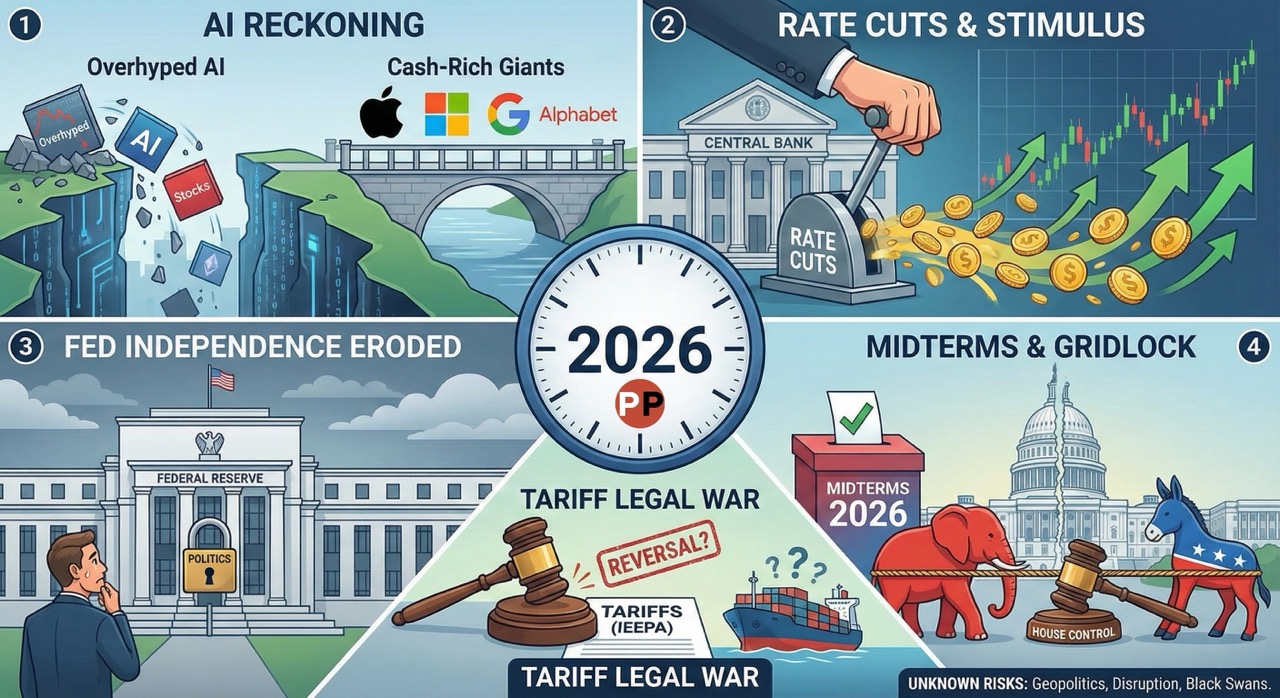

The Investment Landscape of 2026: 5 Market-Moving “Gotchas” to Watch

As we close the books on a volatile 2025, investors are looking toward 2026 with a mix of cautious optimism and acute anxiety. While the fundamental drivers of the market remain intact, the specific headwinds facing the coming year are distinct, complex, and potentially contradictory. 2026 promises to be a year defined by legal battles, Read more

-

Uncovering the “What’s Next” in the AI Gold Rush

The AI revolution is in full swing, and if you’ve been in the market for the last few years, you’ve likely seen incredible gains in companies like Nvidia, Microsoft, and Amazon. The “AI trade” has undeniably become crowded, with a lot of froth around the big-name players and well-established trends. But for those of us Read more

-

Mastering the Relative Strength Index (RSI): A Comprehensive Guide to Unlocking Trading Success

The Relative Strength Index (RSI) is a widely used technical indicator that measures the magnitude of recent price changes to determine overbought or oversold conditions in a stock. Developed by J. Welles Wilder Jr. in 1978, RSI has become an essential tool for traders and investors seeking to identify potential buy and sell signals. What Read more

-

The Current State of Uncertainty: Navigating Turbulent Markets

For context, I write this on February 25th 2025 on a day of market turbulence and high level of uncertainty due to in part to threat of tariffs, sticky inflation, and overall earnings weakening. We’re living in uncertain times, and investors are feeling the heat. The Trump administration’s aggressive pursuit of various economic and political Read more

-

My “What’s Next” Stock Market Investing Strategy

As an investor, I’ve always been drawn to the idea of staying ahead of the curve. While many investors get caught up in the excitement of a particular stock or industry, I’ve developed a strategy that I call “What’s Next.” This approach involves constantly asking myself what’s coming next, what’s around the corner, and what’s Read more