For context, I write this on February 25th 2025 on a day of market turbulence and high level of uncertainty due to in part to threat of tariffs, sticky inflation, and overall earnings weakening.

We’re living in uncertain times, and investors are feeling the heat. The Trump administration’s aggressive pursuit of various economic and political objectives has created a chaotic environment, making it challenging for investors to make informed decisions. This is not a political statement at all. You can agree or disagree with the President’s agenda and objectives. That’s not the point. It’s not the objectives themselves that are causing uncertainty, but rather the unpredictable nature of their implementation. Every day brings new developments, and investors are struggling to keep up.

The Impact of Uncertainty on Investors

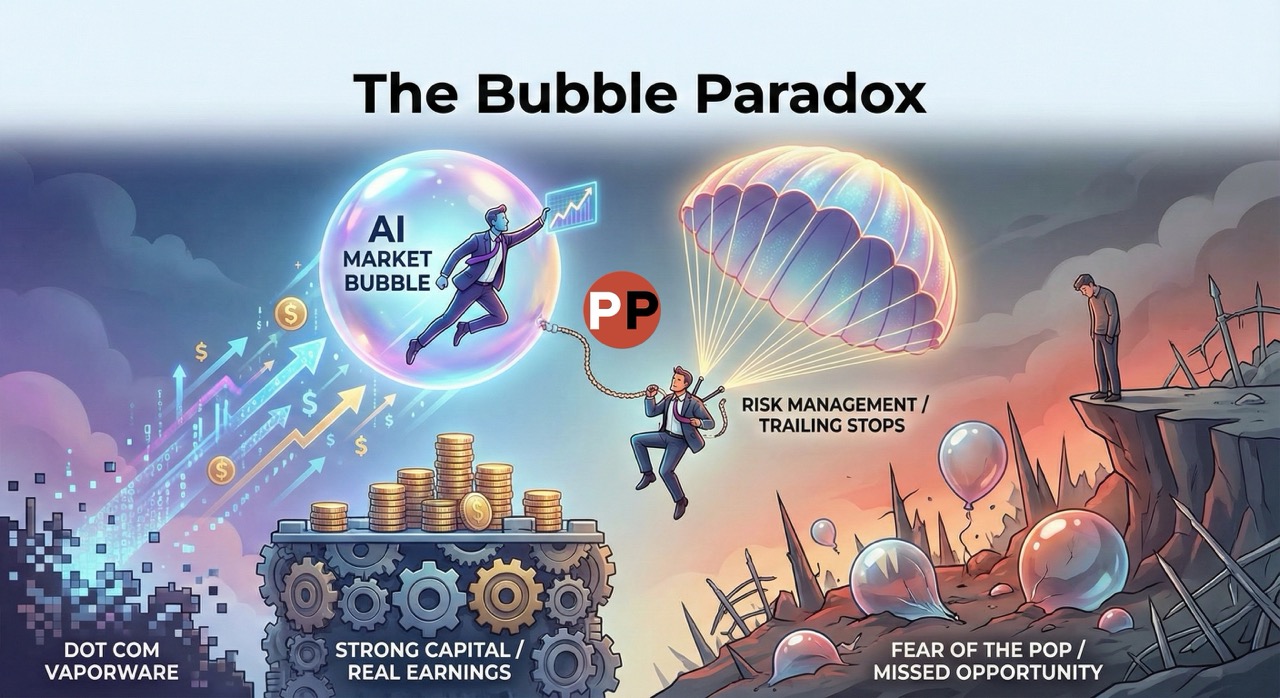

Uncertainty is a natural part of investing, but the current environment is particularly challenging. Investors are hesitant to take risks, and rightly so. When uncertainty is high, it’s essential to prioritize caution and focus on long-term goals. As JP Morgan himself once said, “The stock market will fluctuate”. This statement remains true today, and investors must learn to navigate these fluctuations.

Strategies for Managing Uncertainty

So, how can investors manage uncertainty and make informed decisions? Here are some strategies to consider:

- Diversification: Spread your investments across different asset classes, sectors, and geographies to minimize risk. A diversified portfolio can help you weather market fluctuations and capture growth opportunities.

- Long-term focus: Prioritize your long-term goals and avoid making impulsive decisions based on short-term market movements. A well-crafted financial plan can help you stay focused and avoid emotional decision-making.

- Risk management: Understand your risk tolerance and adjust your portfolio accordingly. Consider working with a financial advisor to create a personalized risk management strategy.

- Tax efficiency: Minimize taxes by holding tax-efficient investments in taxable accounts and less tax-efficient investments in tax-advantaged accounts.

- Dollar cost averaging: Invest a fixed amount of money at regular intervals, regardless of market conditions. This strategy can help you reduce anxiety and stay invested in the market.

- Emergency fund: Maintain an emergency fund to cover 3-6 months of living expenses. This will provide a safety net during market downturns and help you avoid making impulsive decisions.

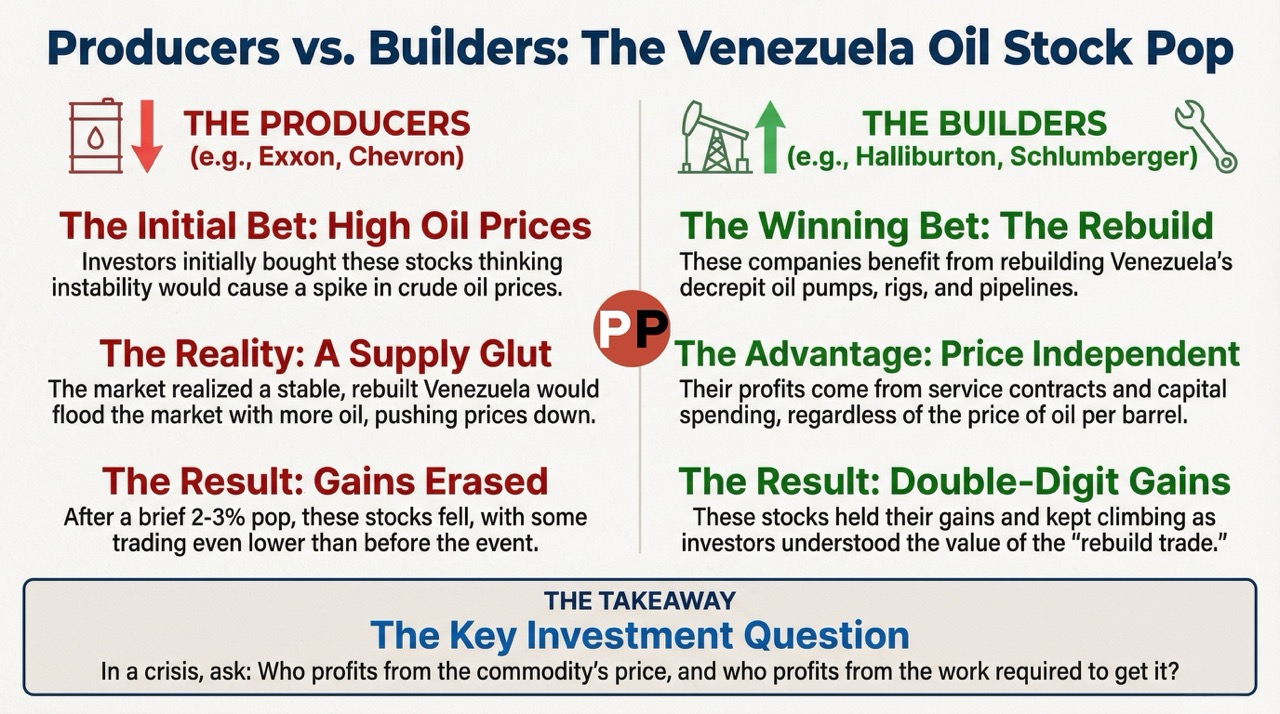

Picking Stocks in Uncertain Times

When it comes to picking stocks in uncertain times, consider the following:

- Look for undervalued companies: Identify companies that have been hit hard by market fluctuations to no fault of their own.

- Focus on quality: Prioritize companies with a proven track record, solid financials, and a competitive advantage.

- Diversify your stock portfolio: Spread your stock investments across different sectors and industries to minimize risk.

Conclusion

Uncertainty is a natural part of investing, but the current environment is particularly challenging. By focusing on long-term goals, diversifying your portfolio, and managing risk, you can navigate these turbulent times. Remember, investors don’t need to know everything, but reducing the number of variables can help reduce uncertainty and risk. Stay informed, stay focused, and work with a financial advisor to create a personalized investment strategy.