As the age-old adage goes, “pigs get fat, but hogs get slaughtered.” This wisdom is particularly relevant in the stock market, where greed and complacency can lead to devastating losses. One strategy that can helps me avoid this fate is taking money off the table frequently. This approach involves securing some of your gains, rather than letting my winnings ride, and it can be a powerful way to manage risk and maximize returns.

The Dangers of Greed

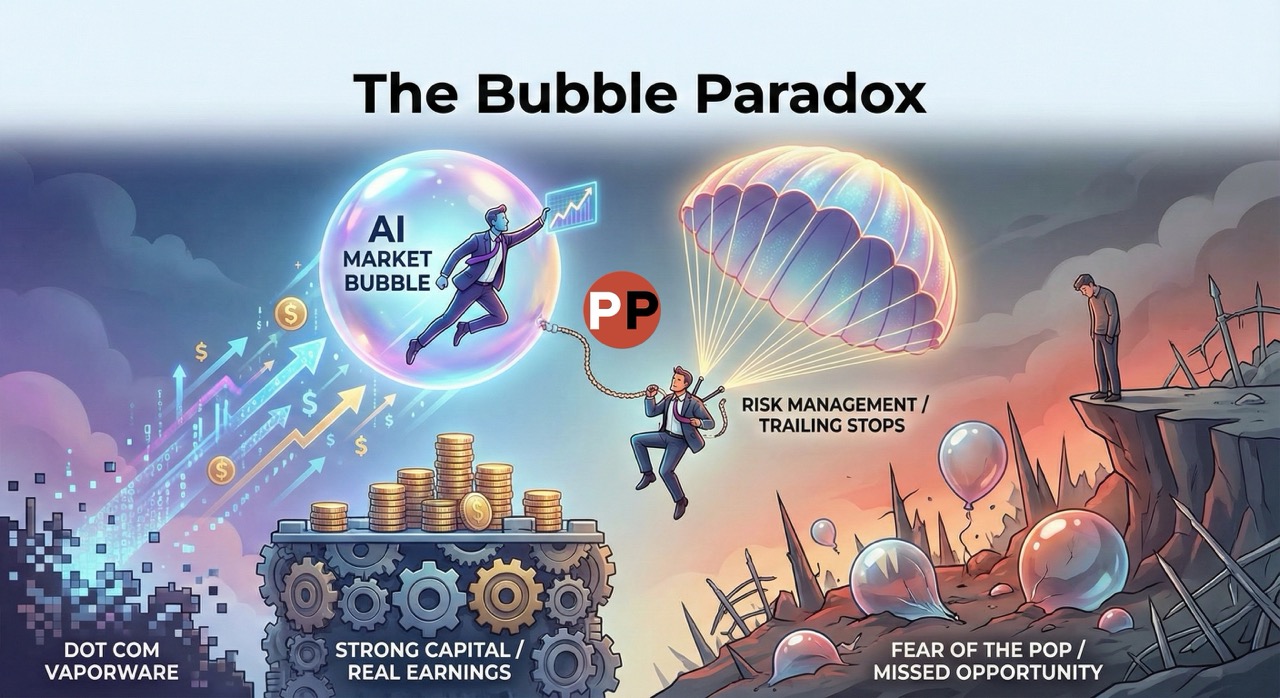

Greed is a natural human emotion, and it can be particularly tempting in the stock market. When my investments are performing well, it’s easy to get caught up in the excitement and convince myself that the good times will keep rolling. However, this mindset can lead to disaster. By failing to take profits and letting my winnings ride, I’m exposing myself to the risk of significant losses.

The Benefits of Taking Money Off the Table

Taking money off the table frequently can help avoid the pitfalls of greed and complacency. By securing some of your gains, you’re locking in your profits and reducing your exposure to market volatility. This approach can also help you:

- Manage risk: By taking money off the table, you’re reducing your risk exposure and minimizing the potential for significant losses.

- Maximize returns: Securing your gains can help you maximize your returns, as you’re locking in your profits and avoiding the risk of losses.

- Live to see another day: Taking money off the table can help you preserve your capital, ensuring that you have the resources to continue investing and pursuing new opportunities.

- Stay disciplined: This approach can help you stay disciplined and focused, as you’re regularly reassessing your investments and making informed decisions about when to take profits.

How to Implement This Strategy

Implementing a strategy of taking money off the table frequently requires discipline and a clear understanding of your investment goals. Here are some tips to help you get started:

- Set clear goals: Define your investment objectives and determine what you want to achieve through your investing activities.

- Establish a profit-taking strategy: Decide on a specific profit-taking strategy, such as taking profits when a stock reaches a certain price or when you’ve achieved a specific return.

- Monitor your investments regularly: Regularly review your investments to determine whether it’s time to take profits or adjust your strategy.

- Stay flexible: Be prepared to adjust your strategy as market conditions change or as your investment goals evolve.

Conclusion

Taking money off the table frequently is a prudent strategy for stock market investors. By securing some of your gains, you’re managing risk, maximizing returns, and staying disciplined. This approach can help you avoid the pitfalls of greed and complacency, ensuring that you live to see another day and can continue to pursue new investment opportunities.

While this strategy requires discipline and a clear understanding of your investment goals, it can be a powerful way to achieve success in the stock market. By incorporating this approach into your investment strategy, you can reduce your risk exposure, maximize your returns, and achieve your long-term financial objectives.