As an investor, I’ve always been drawn to the idea of staying ahead of the curve. While many investors get caught up in the excitement of a particular stock or industry, I’ve developed a strategy that I call “What’s Next.”

This approach involves constantly asking myself what’s coming next, what’s around the corner, and what’s not yet on everyone’s radar.

My goal is to identify emerging trends and opportunities before they become mainstream, and to position myself accordingly. This means being willing to trim gains and even sell stocks that have performed well, but are becoming overhyped. It also means being open to new ideas and perspectives, and being willing to take calculated risks.

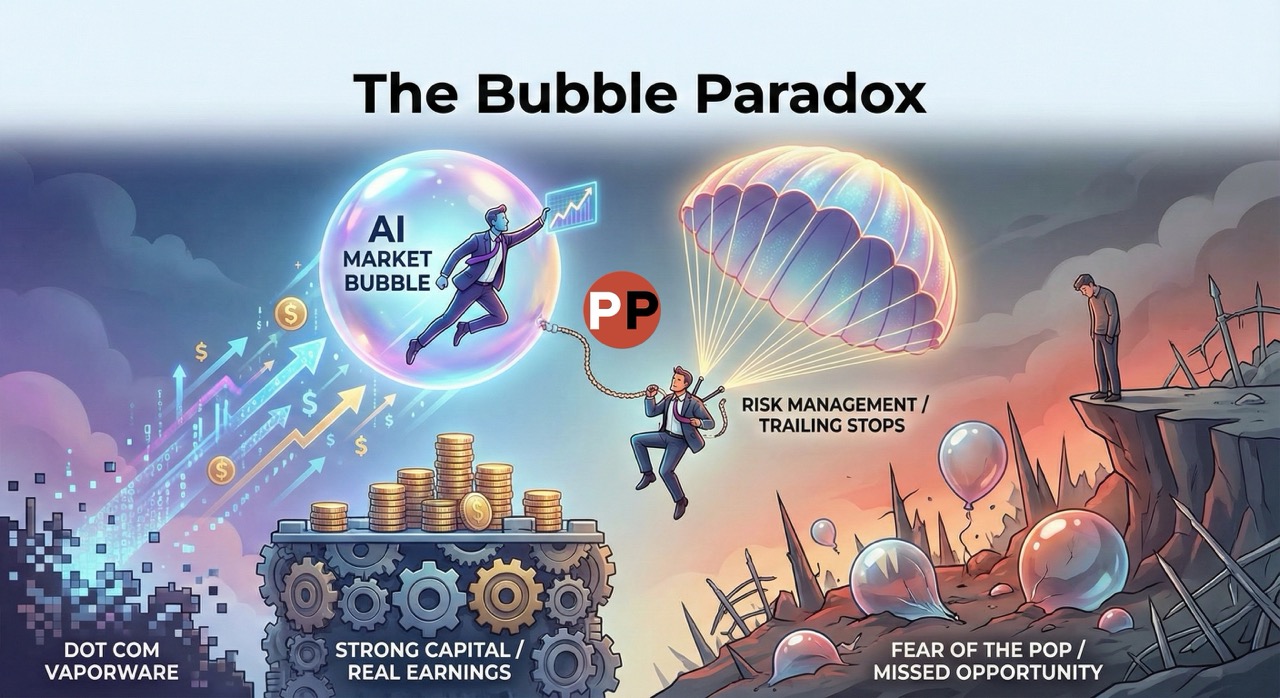

One example of this strategy in action was during the AI hype cycle. As many investors were debating which company would win the AI race – Google, Microsoft, Amazon, or others – I took a step back and asked myself, “What’s next?” It became clear to me that Nvidia had a technological advantage in AI chips, and I took a large position in the stock.

However, as Nvidia’s stock began to soar and every investor on the planet seemed to be piling in, I started to feel uneasy. I trimmed my gains significantly and asked myself again, “What’s next?” This led me to explore other areas related to AI, such as power generation for data centers and cooling systems for AI equipment.

This decision proved to be rewarding, as the focus on AI chips began to wane and investors started to look for the next big thing. By staying ahead of the curve and identifying emerging trends, I was able to position myself for continued growth and success.

The Power of “What’s Next”

So, what is it about the “What’s Next” strategy that makes it so effective? I believe it’s the combination of several key factors:

- Avoiding groupthink: By constantly asking myself “What’s next?”, I’m able to avoid getting caught up in the herd mentality that often drives market trends. Instead, I’m forced to think critically and consider alternative perspectives.

- Staying focused on the future: Rather than getting bogged down in the excitement of the present moment, I’m always looking to the future. This helps me to identify emerging trends and opportunities before they become mainstream.

- Being willing to take calculated risks: The “What’s Next” strategy requires a willingness to take calculated risks and challenge conventional wisdom. This can be uncomfortable at times, but it’s often necessary for achieving long-term success.

- Maintaining a flexible mindset: As new information becomes available and market trends shift, I’m always willing to adjust my strategy and pivot to new areas of opportunity.

Putting the “What’s Next” Strategy into Practice

So, how can you start incorporating the “What’s Next” strategy into your own investing approach? Here are a few tips to get you started:

- Stay informed, but avoid the hype: Stay up-to-date on market trends and news, but avoid getting caught up in the excitement of the moment. Instead, focus on identifying emerging trends and opportunities.

- Ask yourself “What’s next?”: Regularly take a step back and ask yourself what’s coming next. What trends are emerging? What opportunities are on the horizon?

- Be willing to challenge conventional wisdom: Don’t be afraid to challenge conventional wisdom and consider alternative perspectives. This can help you to identify opportunities that others may be missing.

- Maintain a flexible mindset: Be willing to adjust your strategy as new information becomes available and market trends shift.

Conclusion

The “What’s Next” strategy is a powerful approach to investing that can help you to stay ahead of the curve and achieve long-term success. By avoiding groupthink, staying focused on the future, being willing to take calculated risks, and maintaining a flexible mindset, you can position yourself for continued growth and success.

As I continue to ask myself “What’s next?”, I’m excited to see what emerging trends and opportunities the future holds. By staying ahead of the curve and adapting to changing market conditions, I’m confident that I can continue to achieve my investing goals and build long-term wealth.