Momentum trading is a strategy that involves capitalizing on the continuation of existing market trends. It’s all about riding the wave of market momentum to earn profits. This approach is particularly attractive because it doesn’t require pinpoint predictions about market tops and bottoms. Instead, it focuses on catching the wave of market movements, leveraging the inertia that drives financial markets.

Understanding Momentum Trading

Momentum trading is based on the principle that assets in motion tend to stay in motion. This means that if a stock or asset is moving upward, it’s likely to continue doing so for a certain period. The same applies to downward trends. By identifying these trends and jumping on board, momentum traders can potentially earn significant profits.

Identifying Momentum

So, how do you identify momentum in the market? One way is to use technical indicators such as the Relative Strength Index (RSI), Moving Averages, and the Stochastic Oscillator. These indicators can help you gauge market price trends and momentum. For example, the RSI can indicate overbought or oversold conditions, while moving averages can help you identify emerging trends.

Real-World Example

Let’s go back to Trump’s inauguration speech. Imagine it’s January 2025, and you’re anticipating that Trump’s speech will have a significant impact on the stock market. You think ahead of time and predict that his speech will boost the market. You decide to ride the momentum and invest in stocks that are likely to benefit from Trump’s policies.

As it turns out, your prediction is correct, and the market surges after Trump’s speech. You’ve successfully ridden the momentum and earned a profit. This example illustrates the power of momentum trading in anticipating and capitalizing on market trends.

Avoiding Mistakes

While momentum trading can be lucrative, it’s not without risks. To avoid making mistakes, it’s essential to:

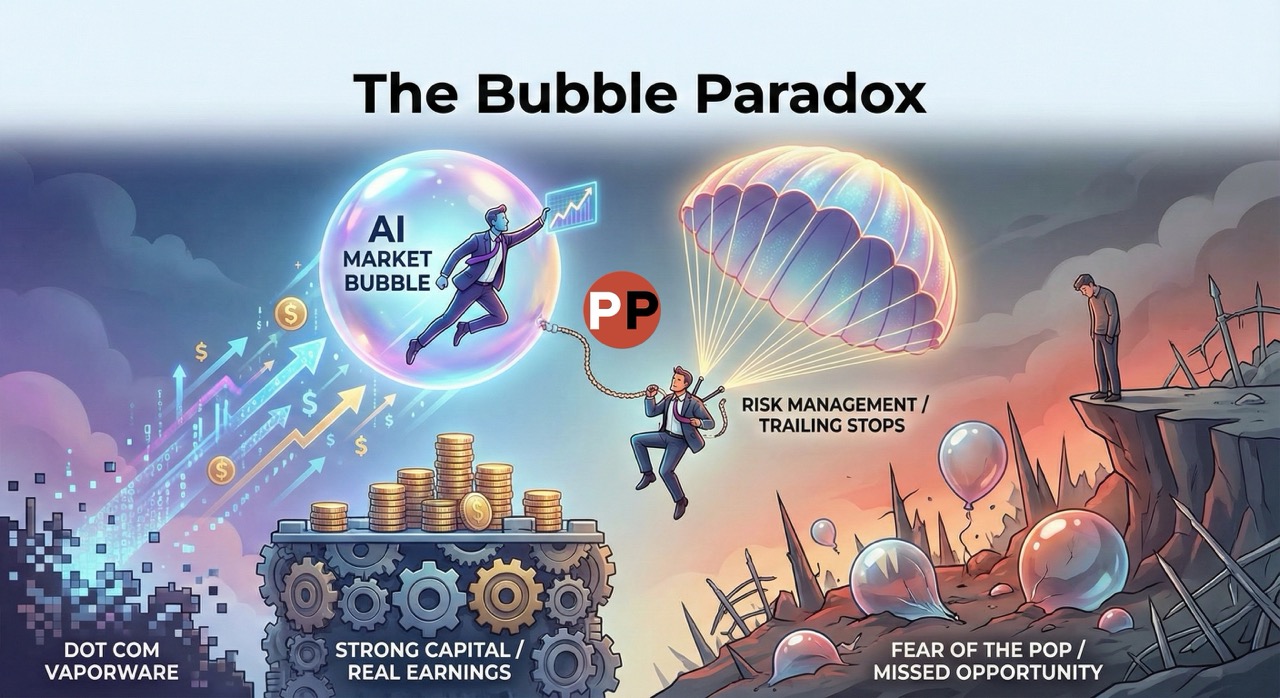

- Use proper risk management: Set stop-losses and limit your position size to minimize potential losses.

- Stay informed: Keep up-to-date with market news and analysis to anticipate potential trend reversals.

- Avoid emotional decisions: Stick to your strategy and avoid making impulsive decisions based on emotions.

- Diversify your portfolio: Spread your investments across different asset classes to minimize risk.

Popular Momentum Trading Strategies

Here are three popular momentum trading strategies:

- Trend Momentum with ADX: This strategy uses the Average Directional Index (ADX) to identify strong trends and ride the momentum.

- Spotting Hidden Divergences: This strategy involves identifying hidden divergences in price action using the Relative Strength Index (RSI).

- Day Trading Pullbacks and Breakouts: This strategy involves entering trades after a price retracement in the direction of the primary trend.

These strategies can be effective in identifying and riding market momentum. However, it’s essential to backtest and refine your strategies to ensure they align with your risk tolerance and investment goals.

In conclusion, momentum trading is a powerful strategy for capitalizing on market trends. By understanding the principles of momentum trading, identifying momentum using technical indicators, and avoiding common mistakes, you can potentially earn significant profits in the markets.